Aside from sprinkling sweet

Oofle dust across the budget, our Chancellor has magic'd away some of the more awkward parts. His central mandate is around achieving fiscal balance by 2019-2020.

I decided to take a look at the post-budget Office for Budget Responsibility (OBR) charts and tables. In my opinion, the big charts now show a 55% probability of hitting George's target by 2019-2020.

I've referred in the past to smudging, that technique to blur the later outcomes of graphs, but I'm wondering if George might need to do something more 'Frank Underwood' in nature to be sure of success.

The House of Cards man would change the game, and I suppose that's a possibility for George.

Looking at the big numbers in OBR, there's a couple of inevitable major contributors to the chance of a miss, in the form of the RDEL and CDEL (run rate and capital expenditure) by the government. It has already been a problem this year for George, who doesn't want to borrow money even when it is very cheap.

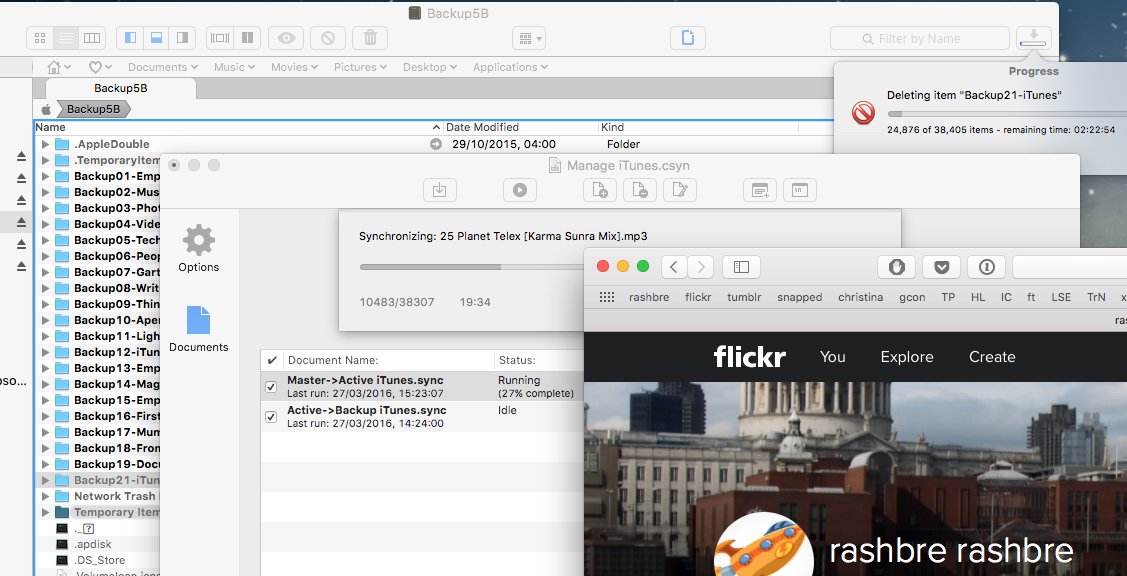

So maybe some reclassifications could help swing things around? We'll need to pay close attention over the next year or so to see whether any new accounting miracles occur. It is surprisingly difficult to keep track of the various pots of money that get shifted around, like a version of that shell game played on Westminster Bridge.

I took a look at the changes to the forecast numbers since last November - just three and a half months ago. There's that £18 billion swing and the new measures to bring it all back in line.

Maybe some fundraising via sell-offs will be used to increase the chance of success? Beyond the delayed Lloyds Bank sell off, there's a chunk of UKAR on the books.

UKAR is the now discounted ex-Northern Rock and Bradford and Bingley business which is still in government ownership. Even for that, late last year they added the Help to Buy ISA into that organisation's remit, so tracking the value of any sell-off is already more complicated.

But, like that shell game, distraction and palming are part of a political skill-set. Izzy whizzy, let's get busy, as Sooty might say.