Wednesday, 23 November 2022

tout va bien - A Book of Days - Patti Smith

Tuesday, 22 November 2022

disgrace

Friday, 18 November 2022

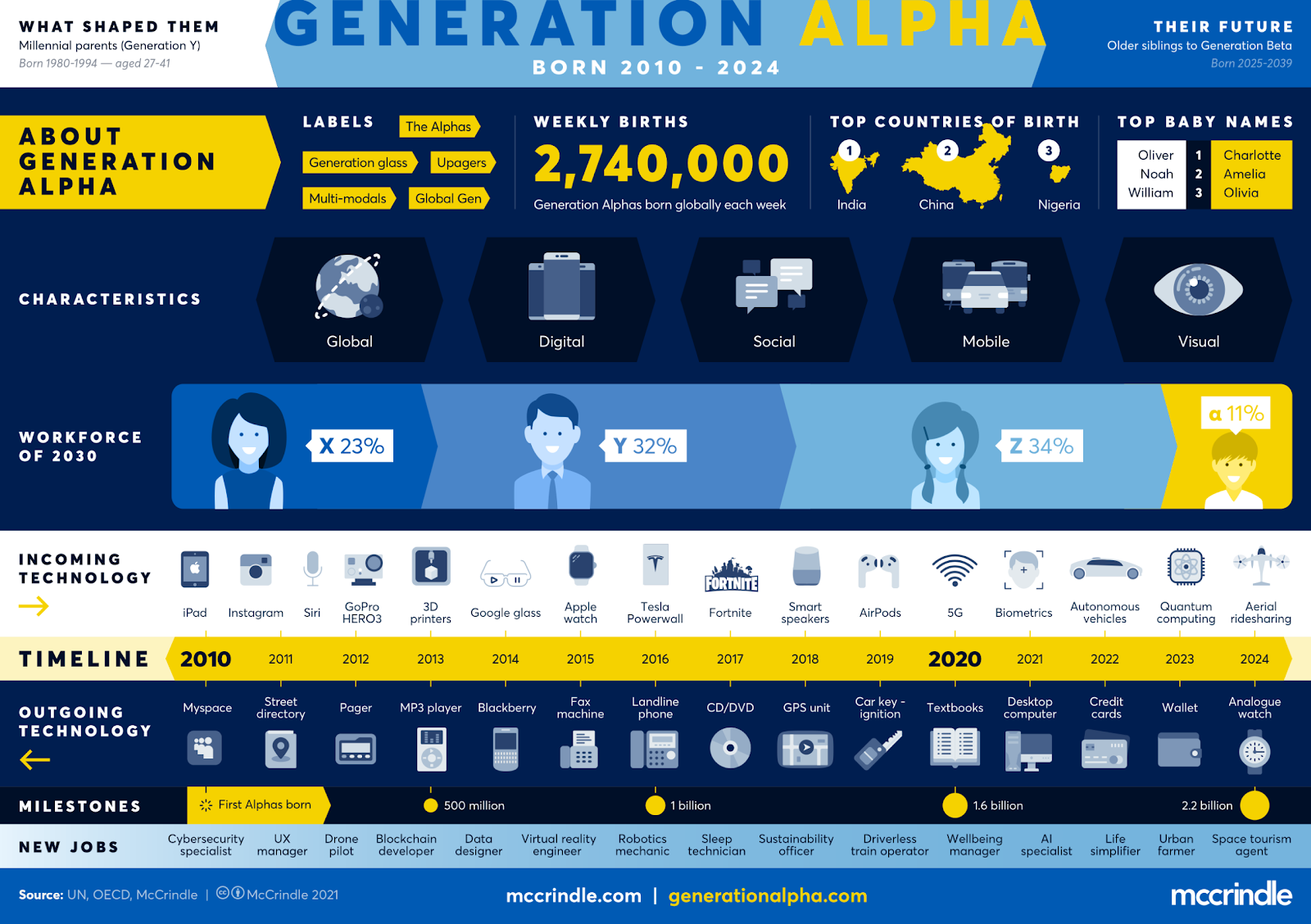

let the alpha birds sing?

Thursday, 17 November 2022

Deeply unfashionable

Blaming Boris might be unfashionable. So might blaming Brexit, which I'm told has been expunged from the Conservative lexicon. Only the con part remains.

Thus I know I'm deeply unfashionable, because I can still consider these six-year aberrations as a starting point for the mess we are in. The 'long, unpleasant journey' as some Middle Englanders may call it.

Monday, 7 November 2022

twitter as a metaphor for life on mars?

I was a low serial number twitterer. I watched it grow and the signal to noise ratio worsen. Then the sheer dumping of extra spam into my twitter feed as the SEO businesses muscled in. No, I don't want your protein pills and my shirts are fine, whatever label they bear. Now we can watch as the whole noisy and increasingly self-referencing platform gets dis-assembled. We can wonder if it will ever have its original promise again. Mars colonisation ?

Thursday, 3 November 2022

round trip with sound

Wednesday, 26 October 2022

gyre and gimbal

It seems that there is a limited talent pool, because I gather that the contenders included the has-been slug from the Premiership-minus-one and the runner-up from the recent selection, voted upon by the finest brains of the membership.

This time, a panic to prevent a further vote, after the frabjous and blatant lies from the slug who pretended to have enough Parliamentarian votes. Vorpal sword time. Snicker snack. Ironically, if his bluff had worked and he had got through to the next round, we'd have probably had him back in power.

Rishi Sunak has his work cut out. I still blame Johnson the most. He was partying hard at the pole wheel, in between his copious vacations, including during term-time. There are no words.

Truss was the unconsciously incompetent replacement and now we have Sunak as the consciously competent one, although perhaps about to be dragged into the mire by some of his so-called associates.

Hasta la próxima.

Thursday, 6 October 2022

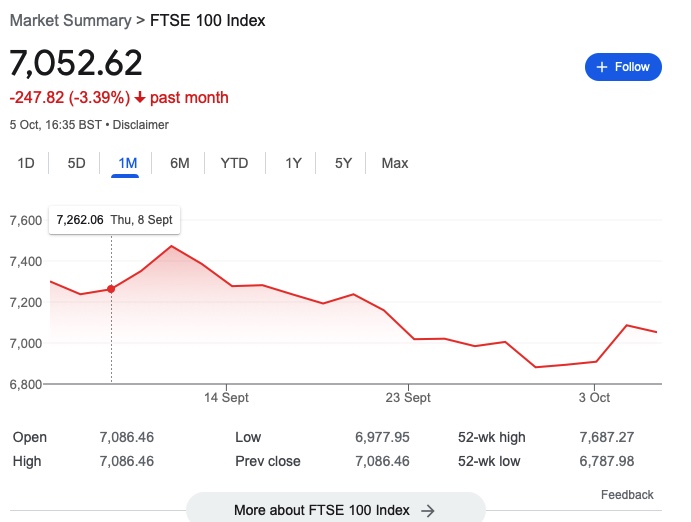

Movin' on down

Johnson didn't set the controls on the plane so that it would crash into a cliff face. He was much too busy squandering political capital to think about steering.

Truss picks up the plane when its front view is all of that rapidly approaching cliff face. A new leader so new political capital? Not this time. Walking on stage to Heather Small singing the M People anthem - "Moving on up" - shame no one vetted the lyrics.

"You’ve done me wrong, your time is up

You took a sip from the devil’s cup

You broke my heart, there’s no way back

Move right out of here, baby, go on pack your bags"Insta-squander. She lives in a bubble of unselfawareness. Her attempt to unite her party has become, instead, one to ignite her party. Crash, Crash, Crash.

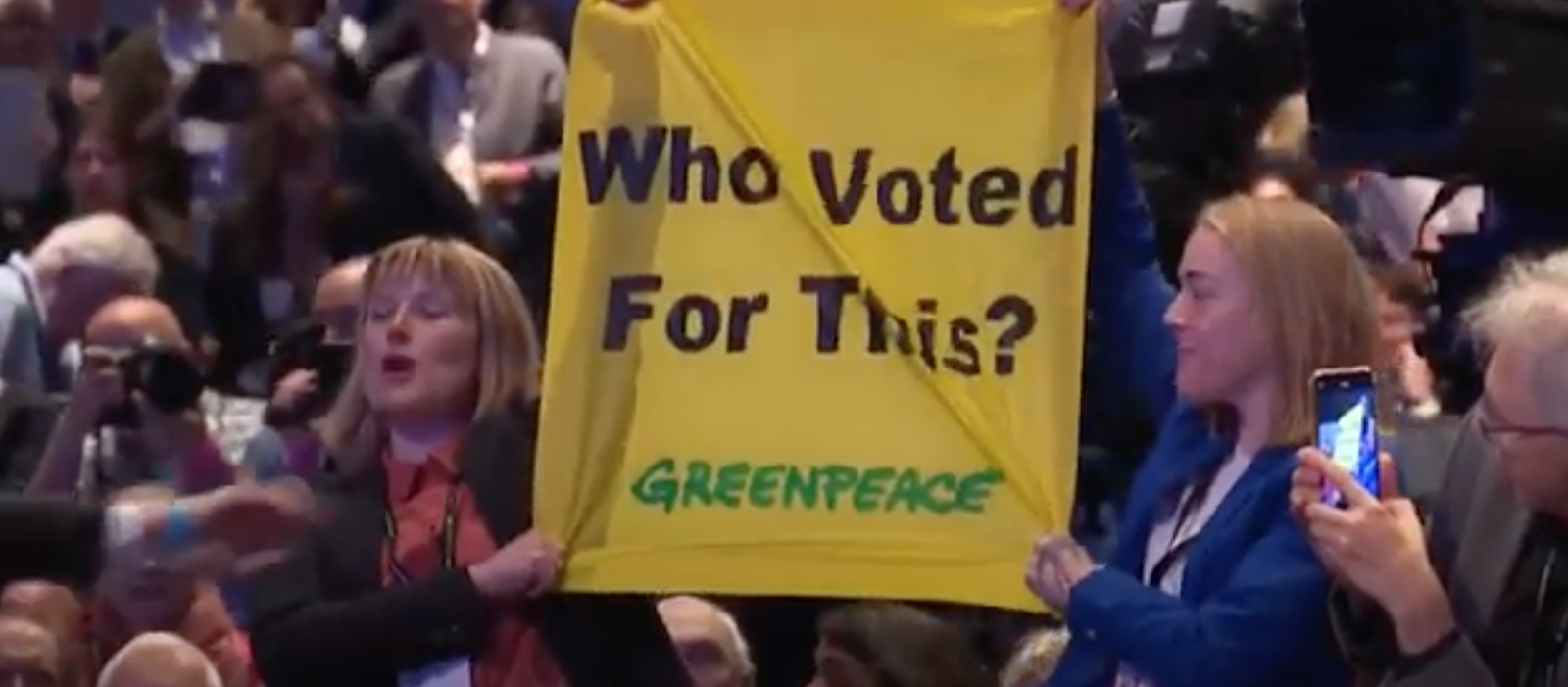

She talks about growth yet is now 38 points behind Labour in national polls. A highlight of her speech was the interruption by Greenpeace, which gave her a chance to adlib over the perfectly valid point raised by Greenpeace that nobody voted for her ideas.

t was telling that she chose to aim at an “anti-growth coalition” whose members include a nameless elite who “taxi from North London town houses to the BBC studio". She looked pleased with herself to pull this off although it's all London-speak, no doubt been prepped by a speech writer. It also sailed clumsily close to the 'elite from North London' - a phrase usually eschewed nowadays.

The subverters are lining up: 'worst (conference) since the 1970s', 'It feels like we've already lost', (accusations of) 'organising a coup', 'get a grip', no mandate to reverse the 2019 manifesto (Gove), 'if we don't want to deliver on the deal, we need a fresh mandate' (Dorries). And I have;t even got around to Mordant, Shapps or the dislikable Rees-Mogg.

Still, she can recover discipline wth hard line tactics, credit piracy and blame avoidance. 50 MPs of the 357 Conservative MPs backed her in the first round. She can tell the rest they must back her or they are sacked, or at least tarnished with reputation damaging innuendo. Some would call it cutting her way to glory. Some one should tell her it doesn't work.

Let us consider:

- a cost of living crisis

- stretched public services

- interest rate rises

- a big jump in mortgage payments

- escalating cost of fuel

- the market's fiscal uncertainty

- decline of the GBP

- losses on the stock market

Wednesday, 5 October 2022

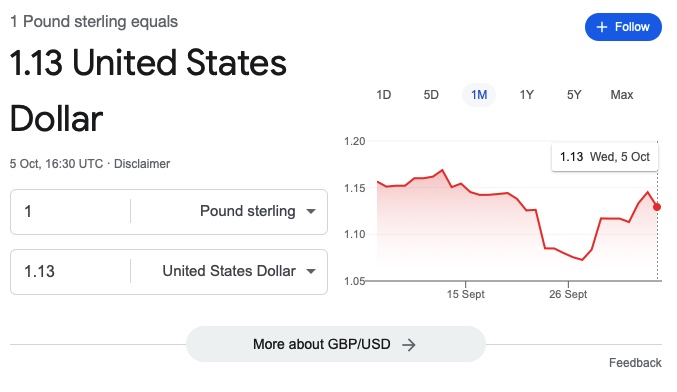

a different kind of arm waving

I can't see this Growth, Growth, Growth thing that Truss is talking about.

She copied the Blair 'Education, Education, Education' triplet of 1996, but having just seen that TV show about 'Would you like to be a Prime Minister', it all came across as, well, a bit like something from The Apprentice.

I checked a number. The FTSE. Share prices aggregation, from when Truss took over to now. Its about a 3.39% drop, drop, drop. We're scraping along just over 7,000. No wonder there's a new tranche of US Funds being launched. Then I tried the GBP to USD. Without the forceful intervention of the Bank of England the GBP would be tanking now. Tank, Tank, Tank. The problem that it creates is that interest rates have moved up and thus the price or mortgages, which has caused almost 1,000 products to be pulled. Fall, Fall, Fall. The one thing that is growing is the cost of mortgages. Fail, Fail, Fail.Tuesday, 4 October 2022

competence is a long road

Wednesday, 28 September 2022

frack

Recently, I've seen Jacob Rees-Mogg break cover to smooth over the fracking story with oleaginous contempt for any challenges. I remember being dismayed by those original lobby pictures I saw, so I wondered what 'levelling up' stories would now be applied to the UK. I see one right wing newspaper is saying how great it is that the north of England has so many fracking opportunities. The potential appeals to 'Red Wall' country?

The Cuadrilla maps don't quite tell the whole story though. By looking at a geo-survey of aquifers and shale it is possible to see that the target zones could drop right into the rich Tory heartlands of the south-east. One of those red squares appears to land on Guildford. Hold that thought.

I remembered the lobby depicted activity around Alberta, so I thought I'd take a look at how things are going. Here's a picture of the effect around an oil sands bitumen recovery site.

An example mine would produce 260,000 barrels per day of bitumen at its peak, cover 24,000 thousand hectares and — during its 41-year lifespan — tap into reserves in the neighbourhood of 3.2 billion barrels.The bitumen requires processing to turn into oil, although some places directly burn the bitumen to generate power. It is all a messy business.

I haven't mentioned the shale gas yet, which is a euphemism for methane/methanol and is the other main target of the frackers. Hydraulic fracturing – commonly known as fracking – is the process used to extract shale gas.

Deep holes are drilled down into the shale rock, followed by horizontal drilling to access more of the gas, as shale reserves are typically distributed horizontally rather than vertically. Fracking fluids containing sand, water and chemicals are then pumped at high pressure into the drilled holes to open up fractures in the rock, enabling the trapped gas to flow into collection wells. The drillers explain that it entirely safe, aside from the occasional accidental fire.

From there it is piped away for commercial use. Methane is 25 times more toxic to the environment that carbon dioxide, so we don't want any of it to escape.

This is another messy business and incorporates a few extra pipes and gadgets.

If all goes well, then there's money in that there Red Wall.

If it goes wrong, we could see a few earth tremors or even some light flooding of the landscape - just like in Alberta.

A steady flow of oil leaking from the ground across four well sites includes the latest covering up to 40 hectares, according to the Alberta Energy Regulator. No one knows how to stop the leaks, which are ongoing. Above ground the search for sites continues...But Rees-Mogg insists it is all okay. Is this what was meant by levelling?

Tuesday, 27 September 2022

Insider knowledge?

A long time ago, when I was learning about economics, the pound to dollar was around 1: 2.40. Some may recognise that a cent was equivalent of an old LSD penny.

Recently, when I was changing money to go to Greece, I noticed that the pound had almost reached parity with the USdollar and that it was bouncing along at the same conversion rate as the €uro.

We've seen a record setting descent after the new Conservative Party budget. There, I've said it. Budget - although by not calling it a budget the Chancellor manages to avoid fiscal scrutiny. That's a Borisovian trick, if ever there was one.

What if a few hedge funds shorted the pound? (In other words, forward sold large quantities of currency they didn't have hoping to pick it up cheaply before their debt was called).

Unhinged Liz decided to host a dinner for hedge fund managers a few days before the KamiKwasi budget.

With the massive hints provided, hedge funds with remarkably close links to the UK government made shed-loads of money.

Everyone else was gobsmacked, to use an economist term. £45 billion in new borrowing for new tax breaks in a curious bid to revitalise an economy facing recession.

Someone likened the trickle down philosophy to hanging from a cliff waiting to be rescued yet the money being provided to the rope-making companies.

More a case of fall-down rather than trickle-down. No wonder one of her victory tweets said she was ‘ready to hit the ground on Day One’. Ouch.

I suggest the puppet-masters will use her to make the UK into a casino for the elite. The recent all-in currency play is merely a taste of the structural changes being discussed to turn UK into an international deregulated tax haven.

Truss may have run for cover over the last few days (guilt or gilt?). There is certainly room for her in the icey hidey-holes that the previous PM used. It is probably easier than having to explain how the new debt will be absorbed.

Let the Bank of England bond-buying commence.